Why Merchant Service Providers Need Verifi Order Insight

Disputes and chargebacks are more than just operational headaches. They are a direct threat to merchant profitability and portfolio health, as well as customer satisfaction and loyalty. Every chargeback triggers administration fees, often upwards of $50 per incident, regardless of outcome. For high-volume portfolios, these costs add up fast, and excessive chargebacks can even result in additional penalties or placement on monitoring programs that endanger acquiring relationships.

MSPs face the dual challenge of minimizing these risks while maintaining merchant satisfaction. Traditional dispute management is reactive, slow, and labor-intensive, leading to lost revenue and strained merchant relationships. Verifi Order Insight addresses these pain points by providing a proactive, data-driven solution that empowers issuers to resolve cardholder disputes before they escalate to chargebacks – often without the merchant ever needing to intervene.

How Verifi Order Insight Works

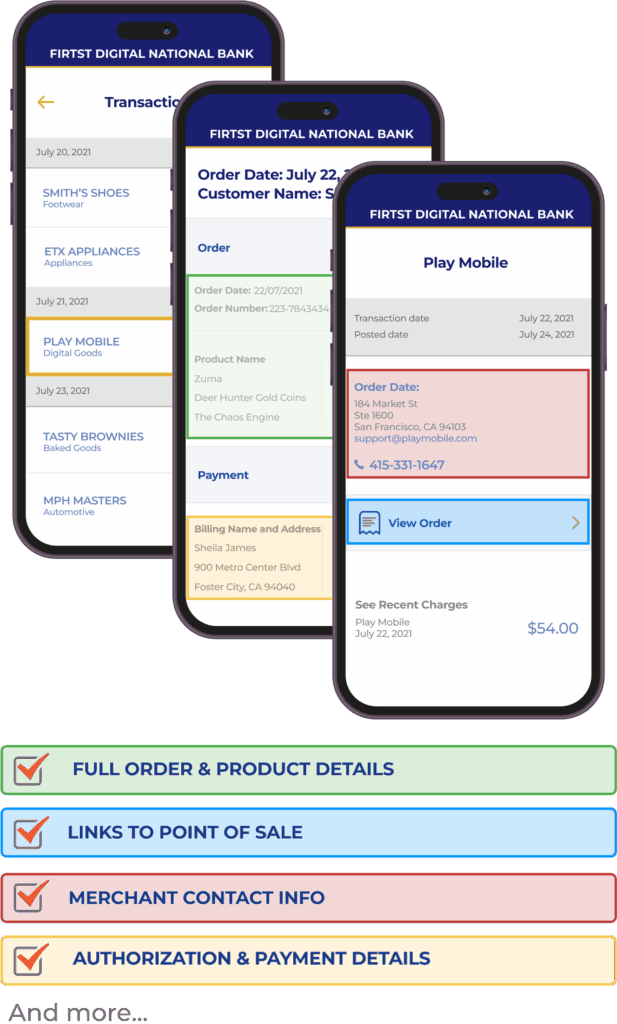

Verifi Order Insight, a Visa service, enables merchants to share detailed transaction data with issuers in real time. When a cardholder contacts their bank to dispute a transaction, the issuer can instantly access enhanced purchase details—such as product descriptions, shipping information, and customer service contacts—directly from the merchant’s systems. This transparency allows the issuer to clarify the transaction with the cardholder, resolving friendly fraud and confusion-driven disputes before they become chargebacks.

DisputeHelp’s integration of Verifi Order Insight is designed for scale and automation. MSPs benefit from:

- Seamless data flow between merchants, issuers, and cardholders, reducing manual intervention.

- Automated workflows that ensure every eligible transaction is covered, regardless of merchant size or vertical.

- Centralized reporting and analytics for portfolio-wide oversight.

This approach not only streamlines dispute resolution but also positions MSPs to offer a higher standard of service to their merchants.

Key Benefits of Verifi Order Insight with DisputeHelp

Reduction in Chargebacks and Dispute Volumes

By providing issuers with the information needed to resolve cardholder questions on the spot, Verifi Order Insight can significantly reduce the number of disputes that escalate to chargebacks. Fewer chargebacks mean lower administration fees, reduced risk of penalties, and keeps risk thresholds well below network tolerance levels.

Improved Merchant Experience and Retention

Merchants benefit from fewer disputes, less revenue loss, and a streamlined process that minimizes operational burden. For MSPs, this translates into higher merchant satisfaction and retention—key drivers of portfolio growth.

Enhanced Portfolio Monitoring and Reporting

DisputeHelp delivers comprehensive analytics, enabling MSPs to track dispute trends, monitor merchant performance, and identify emerging risks. This data-driven approach supports proactive risk management and portfolio optimization.

Competitive Differentiation for MSPs

Offering Verifi Order Insight as part of a white-labeled, automated dispute management suite sets MSPs apart from competitors. It signals a commitment to innovation, merchant advocacy, and operational excellence.

Implementing Verifi Order Insight: What to Expect with DisputeHelp

- Streamlined Integration: DisputeHelp’s technical team manages API connections and data mapping, minimizing IT burden for both MSPs and their merchants.

- White-Label Options: The DisputeHelp platform can be fully branded to match the MSP’s identity, ensuring a seamless experience for merchants and reinforcing the MSP’s value proposition.

- Ongoing Support and Optimization: DisputeHelp provides continuous monitoring, reporting, and optimization recommendations, ensuring that Verifi Order Insight delivers maximum impact across the merchant portfolio.

“Chargeback rates rose 19% in 2024, with first-party and true fraud driving the increase. Online travel and lodging saw an 816% spike, e-commerce experienced a 222% rise, and digital goods and services saw a 59% increase.” – Sift

Next Steps: Scale Your Dispute Management with DisputeHelp

If you’re ready to reduce chargebacks and improve merchant satisfaction at scale, contact our team to explore how Verifi Order Insight can be integrated across your portfolio. Whether you’re managing a high-risk vertical or just looking for a smoother path to CE 3.0 compliance, we’re here to help you move fast and scale with confidence.

Why DisputeHelp?

DisputeHelp provides merchant service providers with scalable dispute resolution solutions including Verifi Order Insight, CE 3.0 automation, portfolio-wide analytics, and white-label customization. Our all-in-one platform simplifies compliance, strengthens merchant relationships, and gives you a true edge in a crowded provider landscape. Reach out to our team to see how we can support your goals.

FAQs: Verifi Order Insight for MSPs

What is Verifi Order Insight and how does it work?

Verifi Order Insight gives issuers and cardholders immediate access to detailed transaction data. When a cardholder contacts their bank or checks their mobile app to question a charge, issuer agents can pull enriched data in real time, including merchant descriptors, itemized orders, fulfillment details, and digital interactions. This often resolves confusion before the inquiry escalates. For merchants and their service providers, Order Insight plays a critical role in dispute prevention and is also required to unlock Visa’s automated chargeback blocking feature, Compelling Evidence 3.0. With the right setup, this integration enables preemptive protection against first-party fraud with no action required from the merchant. DisputeHelp’s DEFLECT solution connects your portfolio to Order Insight and automates CE 3.0 compliance with no manual data mapping or merchant-side actions required.

How does Verifi Order Insight reduce chargebacks?

Through the use of enhanced transaction details, Verifi Order Insight prevents many disputes from escalating to formal chargebacks. This leads to fewer chargeback administration fees, lower risk of penalties, and improved merchant satisfaction, portfolio-wide.

What are the integration requirements for Verifi Order Insight with DisputeHelp?

DisputeHelp manages the technical integration, including API connections and data mapping. MSPs and merchants typically need to provide transaction data feeds and basic account information. Our team handles the entire IT process to ensure rapid deployment for your business.

Can Verifi Order Insight be white-labeled for my merchant portfolio?

The Order Insight service itself is a Visa-branded product and cannot be rebranded. However, the platform MSPs use to deliver Order Insight access to their merchants can be fully white-labeled. DisputeHelp provides a customizable portal and integration layer that allows you to offer Order Insight and other resolution tools under your own brand, creating a seamless merchant experience and reinforcing your value in the market. To explore white-label deployment options for your merchant portfolio, contact our team for a quick walkthrough.

What reporting and analytics are available through DisputeHelp?

DisputeHelp provides comprehensive portfolio-wide analytics, including dispute and chargeback trends, merchant performance metrics, and risk indicators. These insights support proactive risk management and ongoing optimization.

How quickly can MSPs expect to see results after implementing Verifi Order Insight?

Most MSPs begin to see a measurable reduction in chargebacks and improved merchant satisfaction within the first few months of implementation. The impact is often immediate for high-dispute portfolios, with ongoing optimization further enhancing results over time. Contact the DisputeHelp team to learn what your particular business can expect in regard to time frames as well as results.