The Rising Cost of Chargebacks in 2025

Chargebacks have always been a costly problem, but Mastercard’s latest insights confirm that the stakes have increased significantly. Mastercard reports that a chargeback in 2025 could cost a merchant up to 3.4 times the value of the transaction. This figure reflects not just the transaction reversal but the combined impact of fees, administrative work, and long-term consequences like lost processing volume. For MSPs, this translates into portfolio-wide risk that can jeopardize entire segments of their merchant base, particularly if chargeback activity pushes accounts toward monitoring programs or penalties from the card networks.

Chargebacks: More Than Just Lost Revenue

It’s easy to think of chargebacks as isolated revenue reversals, but Mastercard’s analysis emphasizes that they represent much more. Every chargeback triggers internal operational costs, from staff time spent reviewing and responding to disputes to the administrative burden of updating systems and records. These hidden costs strain MSP resources at scale. In addition, chargebacks damage merchant reputations. This can have a compounding effect, as merchants who accumulate chargebacks may struggle to maintain processing relationships or negotiate favorable rates. Ultimately, unchecked chargebacks can shrink overall portfolio processing volumes, cutting into revenue for both merchants and MSPs.

Risk Amplification for High-Risk Merchant Categories

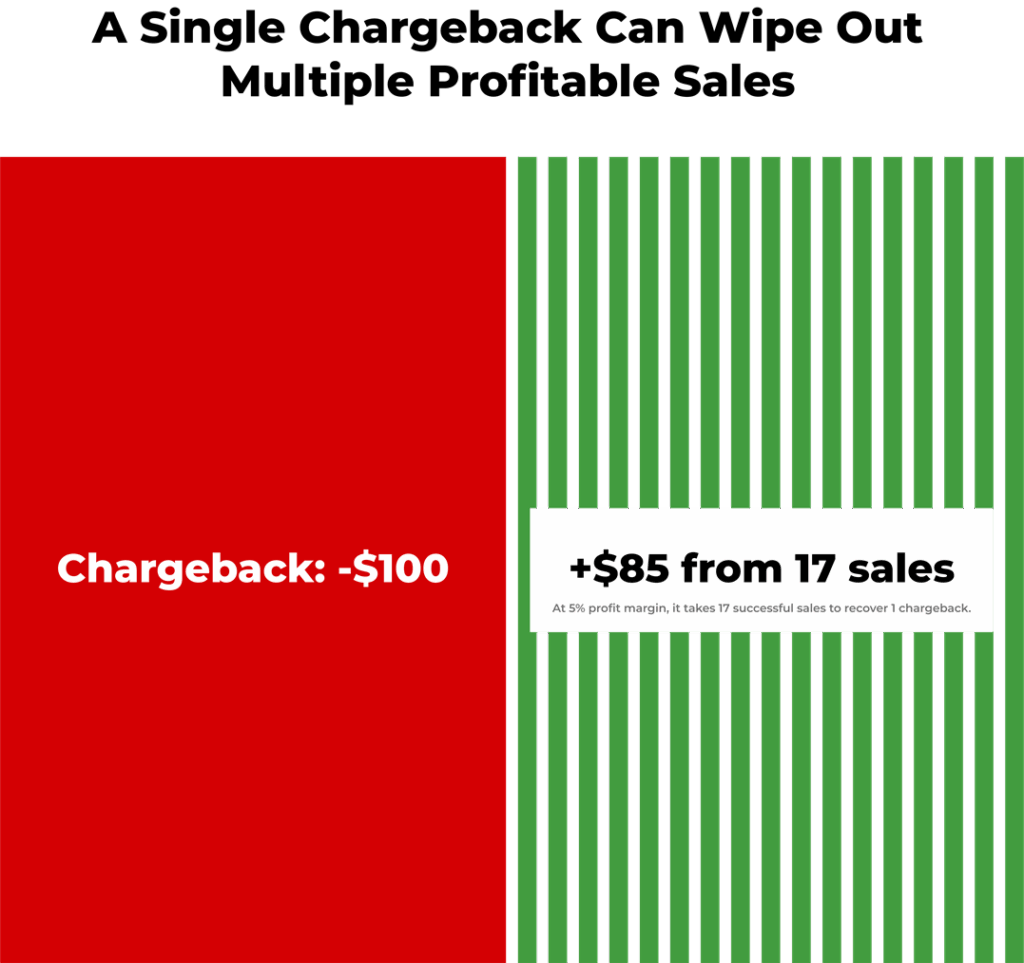

Some merchant categories feel the cost of chargebacks more acutely than others. Mastercard’s report highlights that sectors with high average transaction values or elevated dispute rates face outsized financial exposure. For MSPs supporting high-risk verticals like online entertainment, supplements, or hospitality, chargebacks could potentially wipe out the margin on multiple transactions at once. What might seem manageable at the individual merchant level can quickly spiral into portfolio-level exposure when hundreds or thousands of merchants are involved.

Why Proactive Chargeback Prevention Is Essential

Mastercard’s report makes clear that reactive approaches to chargebacks are no longer enough. MSPs need to focus on proactive chargeback reduction strategies that limit the chance of chargebacks occurring in the first place. By the time a chargeback is filed, the financial damage is already done. Early resolution tools like Verifi CDRN, Ethoca Alerts, Visa Rapid Dispute Resolution, and Mastercom Collaboration can help stop disputes before they become chargebacks. For MSPs, integrating these solutions across their portfolios means fewer losses, reduced administrative burden, and stronger relationships with their merchant clients.

Where MSPs Can Gain a Competitive Edge

Understanding the full cost of chargebacks gives MSPs a unique opportunity to differentiate their services. By offering proactive chargeback reduction solutions as part of their standard portfolio support, MSPs can position themselves as true partners to their merchants. White-label platforms that combine multiple prevention and resolution features allow MSPs to deliver this value while protecting their own brand. With chargebacks cutting so deeply into merchant revenue in 2025, MSPs that provide end-to-end prevention and resolution support will stand out in a competitive marketplace.

Team Up with DisputeHelp to Get Started

If you are looking for ways to reduce chargeback costs across your merchant portfolio, now is the time to act. The true cost of chargebacks in 2025 is too high for MSPs to rely on outdated, reactive strategies. DisputeHelp can support your efforts with scalable, white-label solutions that help prevent chargebacks before they happen and streamline resolution when they do occur. Start the conversation today! Contact us here to speak with one of our experienced chargeback management representatives.

Why DisputeHelp?

DisputeHelp offers merchant service providers a competitive edge with an integrated platform that automates chargeback prevention and resolution at scale. Our solutions help MSPs reduce chargeback exposure, sustain acceptable dispute ratios, and protect portfolio revenue. With full white-label capabilities, DisputeHelp makes it easy for MSPs to offer chargeback management as part of their own brand while simplifying operations across even the largest portfolios.

FAQs: The True Cost of Chargebacks in 2025

What does Mastercard say about the true cost of a chargeback in 2025?

Mastercard reports that the cost of a single chargeback could be up to 3.4 times the transaction value, accounting for fees, operational expenses, and lost processing volume.

Why is the true cost higher than the transaction value?

The cost includes not just the refund but also network fees, operational labor, and downstream impacts on processing relationships and rates.

Which merchant categories face the highest chargeback costs?

High-risk verticals like supplements, SaaS, online gaming, and hospitality face greater exposure because of higher average transaction values or higher dispute rates.

How can MSPs reduce the true cost of chargebacks?

MSPs can reduce costs by implementing proactive chargeback prevention solutions that stop disputes before they escalate into chargebacks.

Why should MSPs act now on chargeback prevention?

Because the financial risks in 2025 are greater than ever. Proactive prevention protects merchants, reduces portfolio exposure, and helps MSPs sustain processing volumes.

What tools help prevent chargebacks before they post?

Solutions like Visa Rapid Dispute Resolution, Verifi CDRN, Ethoca Alerts, and Mastercom Collaboration enable early intervention to resolve disputes before chargebacks occur.