The latest mandates from Visa and Mastercard position 2025 as a pivotal year for acquirer liability in fraud and disputes within merchants’ transaction streams. When merchants can effectively prevent disputes, acquirers gain a significant competitive edge.

Compelling evidence is crucial for dispute prevention—transaction and fulfillment data that connects cardholders to their purchases, effectively reducing disputes. Merchants who provide this evidence during cardholder or issuer inquiries may reduce disputes by up to 80%.

In this guide, we’ll outline how to equip your merchants with this capability, introduce the tools that enable success, discuss the relevant mandates, and present a clear action plan for implementation.

The Business Case for Compelling Evidence

Visa and Mastercard provide tools to route compelling evidence directly to issuers and cardholder inquiries. They’ve also issued mandates to define what qualifies as “compelling,” enhancing these tools’ effectiveness for merchants.

THE TOOLS

Compelling evidence can be routed to cardholder and issuer inquiries through two essential tools:

Verifi Order Insight (OI)

Provides detailed transaction data to cardholders and issuers, resolving disputes. Resolutions via OI are exempt from Visa’s fraud and dispute ratios.

Ethoca Consumer Clarity (CC)

Shares transaction data to clarify purchases, reducing disputes and improving resolution rates.

Here’s an overview of these tools in the customer journey, as they are integrated into DisputeHelp’s DEFLECT module:

Both tools integrate into the customer journey through DisputeHelp’s DEFLECT module, connecting cardholders’ online statements and issuers’ call centers. These tools address the main causes of disputes: transaction confusion and first-party fraud.

THE MANDATES

Visa and Mastercard’s mandates define when compelling evidence is sufficient to resolve disputes:

Visa Compelling Evidence 3.0

Applies to recurring transactions. Disputes cannot proceed if a disputed transaction matches two previous undisputed transactions.

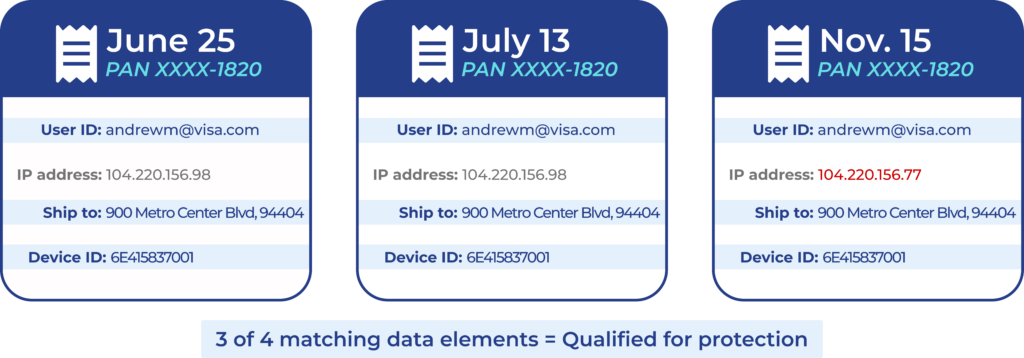

Mastercard First-Party Trust

Whereas CE3.0 matches evidence across transaction, FPT matches evidence to the cardholder based on three factors: Device, Delivery and Cardholder ID.

Challenges

Despite the opportunities, Acquirers and PSPs face significant hurdles in optimizing compelling evidence processes.

- The Last Mile While Acquirers and PSPs often have strong data visibility from merchant to issuer, they lack visibility into the ‘last mile’—data between the merchant and the cardholder. This data typically resides in merchant platforms like CRMs, call centers, and fulfillment systems.

- Tool Distribution to Merchants Integrating tools like OI and CC with merchant last-mile assets is complex and resource-intensive. High-maintenance integrations make it challenging to scale adoption across merchant portfolios.

- The Last Mile in Under 2 Seconds Visa and Mastercard require that last-mile data be sent to issuers or cardholders on demand, in under 2 seconds. Meeting this speed threshold requires robust infrastructure and seamless integration with merchant systems.

Action Plan for Success

Given the above challenges, a strategic and proactive approach is essential. Acquirers and PSPs should focus on the following steps:

- Optimize Evidence Management Automate the collection, validation, and submission of compelling evidence to meet speed and accuracy requirements.

- Proactively Educate Merchants Provide training and resources to help merchants integrate tools like OI and CC into their last-mile systems.

- Enhance Fraud Detection Invest in advanced fraud detection systems to flag disputes early and reduce chargeback volumes.

- Monitor and Adapt to Evolving Mandates Stay updated on Visa and Mastercard requirements, and ensure processes evolve to meet new standards.

- Differentiate Through Value-Added Services Offer services like dispute analytics dashboards or real-time fraud prevention tools to stand out in a competitive market.

Conclusion

The shift toward leveraging compelling evidence is reshaping the payments landscape. By addressing last-mile challenges, adopting key tools like OI and CC, and implementing a clear action plan, Acquirers and PSPs can navigate these mandates effectively. The time to act is now—success lies in agility, innovation, and a proactive approach.