Quick Take

Chargeback alert systems are essential for modern MSPs looking to protect their merchant portfolios from preventable disputes. This article breaks down how chargeback alerts work, the differences between alert providers, and what to consider when selecting a solution that supports both operational efficiency and merchant retention at scale.

Managing hundreds—or thousands—of merchant accounts can mean managing hundreds—or thousands—of disputes and chargebacks. And when a chargeback hits, it’s not just the merchant who suffers. High chargeback ratios can drag down portfolio performance, trigger card network compliance actions, and impact processing relationships.

For merchant service providers implementing a strategic chargeback alert solution isn’t optional—it’s quickly becoming a necessity. The right alert system can reduce dispute rates across your portfolio, improve merchant satisfaction, mitigate fraud losses, and even become a revenue-generating value-add.

What Are Chargeback Alerts?

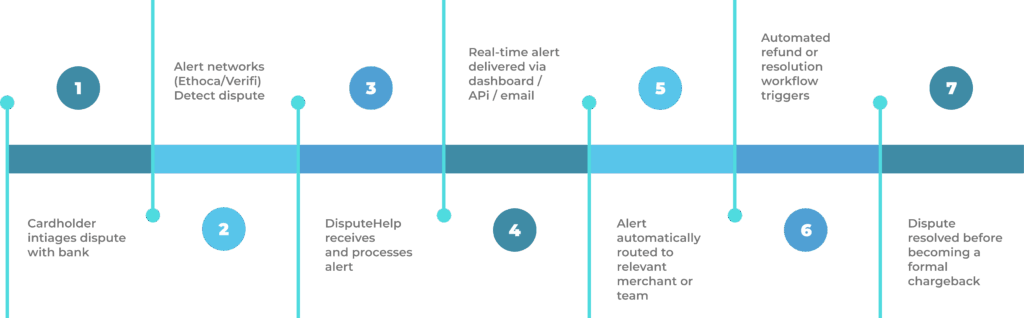

Chargeback alerts are early-warning notifications triggered the moment a cardholder initiates a dispute. Instead of waiting for the dispute to escalate into a formal chargeback (which can take days, weeks or even months), merchants have a window of time—typically 24 to 72 hours—to resolve the issue (usually by refund) and avoid fees and account damage. Certain solutions can speed this further by responding automatically.

Key Alert Providers and How They Work

Most MSPs rely on third-party providers like DisputeHelp to access alert networks. Here’s a breakdown of the primary solutions available in the market today

Visa RDR

- Only works with Visa transactions

- Eliminates manual steps by automating the dispute-resolution process

- Facilitates real-time communication and data sharing between merchants and issuers

- Mandated for issuers and acquirers

Verifi CDRN

- Offers real-time chargeback alerts from Visa and other leading card networks.

- Enables refunds before a chargeback is filed.

- Strong US coverage.

- Part of Visa’s official prevention ecosystem, works in tandem with tools like Order Insight and Rapid Dispute Resolution.

Mastercom Collaboration

- Only works with Mastercard transactions.

- Not automated by default.

- If a merchant is part of the Ethoca network, alerts will route there first. This is a great backup to cover merchants who aren’t in the network.

- 72 hour window to respond.

- Mandated for issuers and acquirers.

Ethoca Alerts

- Offers real-time chargeback alerts from Mastercard and other leading card networks.

- Strong international coverage.

- Often includes supplemental fraud alert data.

- 24 hour window to respond.

- Expands merchant visibility into non-Visa disputes.

Important: Each alert network has unique coverage footprints. The most effective strategy is integrating both to ensure maximum protection across your merchant portfolio.

Alert System Features MSPs Should Prioritize

When evaluating a chargeback alert system for your portfolio, consider the following features:

- Network Breadth: Does it consolidate necessary tools into a single interface?

- Automated Refunds: Can you configure refund logic based on alert type, transaction value, or merchant category?

- Reporting & Analytics: Are alert trends and resolution outcomes visible at the portfolio level?

- Scalability: Can the system manage alerts across hundreds or thousands of merchants?

- Integration Options: Does it connect with merchant CRMs, gateways, and internal dashboards?

- Support Model: Is it a fully managed service or self-serve? Does it fit your operating model?

A robust system should offer control and visibility across your entire merchant portfolio, not just at the individual MID level.

Why Alerts Are Now a Merchant Expectation

Merchants today expect proactive dispute protection. In fact:

- Upwards of 75% of merchants are now using third-party providers for their dispute alerts (PYMNTS)

- Chargebacks cost merchants over €50B annually (Datos Insights)

- 76% of merchants say dispute management tools are effective at protecting revenue (Datos Insights)

As MSPs seek to differentiate their service offerings, the ability to proactively mitigate disputes has become a top-tier selling point. Alerts give your clients the confidence that they’re not flying blind—something that directly improves retention and portfolio longevity.

How to Choose the Right System for Your Needs

No two portfolios are the same. High-risk verticals, average ticket values, international card usage, and internal operations all affect the ideal system configuration.

Here’s a simple evaluation framework:

| Factor | Considerations |

|---|---|

| Merchant Type | Do your merchants operate in high-risk verticals or subscription models? |

| Geographic Coverage | Do you need global issuer support or primarily domestic alerts? |

| Internal Resources | Do you want to self-manage alerts, automate responses, or fully outsource? |

| Integration Complexity | Do your merchants use a variety of CRMs and gateways that need to be mapped to alerts? |

| Cost Sensitivity | Are your merchants more focused on cost control or on dispute success rates? |

Once mapped, you can identify whether you need a managed, automated, or hybrid solution.

Want Help Integrating the Right Alert System?

If you’d like help selecting and implementing chargeback alerts across your merchant portfolio, our team at DisputeHelp specializes in enterprise-grade solutions. We support Ethoca Alerts, Verifi CDRN, Visa RDR and Mastercom Collaboration through a unified interface that’s purpose-built and available in a white-labeled variety for MSPs. Reach out to us today to learn how we can help protect your merchants and your business from preventable disputes.

Why DisputeHelp?

DisputeHelp delivers turnkey dispute prevention and dispute management solutions tailored for merchant service providers. Our white-label platform integrates Verifi CDRN, Ethoca Alerts, Visa RDR, and Mastercom Collaboration into a single scalable endpoint giving your entire portfolio the ability to resolve disputes before they become chargebacks.

We offer both managed and self-service options, comprehensive data capture capabilities, and seamless integration with your existing merchant stack. With DisputeHelp, you’re not just defending revenue you’re strengthening merchant trust, improving MID health, and setting a new standard for dispute readiness across your portfolio.

FAQs: Choosing the Right Chargeback Alert System

What’s the main difference between Verifi and Ethoca alerts?

Verifi primarily covers Visa disputes with a focus on US transactions; Ethoca focuses on Mastercard and other networks, especially outside the U.S.

How long do merchants have to respond to an alert?

Typically 24–72 hours depending on the issuer and alert type. Timing is critical to avoid a chargeback.

Can alert systems issue refunds automatically?

Yes, many platforms allow automatic refunds based on predefined rules, reducing manual intervention. With Visa RDR all refunds are automatic.

What happens if a merchant doesn’t respond to an alert?

If unresolved, the alert typically escalates into a chargeback, and associated fees and penalties apply.

Is there overlap between different types of alerts?

There can be. Thankfully, the right provider will offer anti-duplication logic and refunds when errors occur.

Can I manage alerts across multiple MIDs in one system?

Yes. Enterprise-grade solutions like DisputeHelp offer portfolio-level visibility and configuration.