Understanding High-Risk Portfolio Vulnerabilities

High-risk merchant portfolios often include businesses like online dating, CBD retailers, nutraceuticals, and sports betting platforms. These sectors experience heightened chargeback activity due to their transaction types, marketing models, or legal ambiguity. Networks view these industries as riskier, so even a small spike in disputes can trigger consequences.

MSPs must manage this risk across all accounts simultaneously. One merchant operating beyond acceptable thresholds could jeopardize your entire portfolio’s standing with the networks. That’s why chargeback prevention must be a portfolio-level discipline—not just a merchant-level concern.

Common Chargeback Triggers in High-Risk Verticals

Understanding recurring chargeback causes in high-risk industries helps MSPs identify trends before they become systemic. These include:

- Subscription billing confusion or auto-renewal complaints

- Delivery or access issues for digital goods or services

- Unrealistic service expectations or deceptive marketing

- High rates of friendly fraud or buyer’s remorse

Prevention strategies must address these triggers with portfolio-wide safeguards and education.

Portfolio-Level Risk Assessment

Begin with a thorough risk assessment across your merchant portfolio. This ensures prevention strategies are based on actual exposure and not assumptions. Key actions include:

- Segmenting merchants by risk category using chargeback history and transaction trends

- Identifying accounts nearing card network monitoring thresholds

- Reviewing common chargeback reason codes across all merchants

- Auditing current prevention tactics for coverage gaps

Chargeback Risk by Industry

| Industry | Est. Chargeback Rate | Key Risk Factors |

|---|---|---|

| Adult Entertainment | 1% – 3%+ | High dispute frequency, fraud, buyer remorse |

| Online Gambling | 1.5% – 3%+ | Unauthorized transactions, legal restrictions |

| CBD & Cannabis | 1% – 2%+ | Regulatory confusion, delivery disputes |

| Nutraceuticals | 1% – 2.5%+ | Recurring billing, unverified claims |

| Cryptocurrency | 1.5% – 4%+ | Volatility, transaction irreversibility |

Authentication and Compelling Evidence 3.0

Standard fraud filters aren’t enough in high-risk verticals. Advanced tools like Compelling Evidence 3.0 help demonstrate legitimate customer behavior across multiple transactions. When implemented at the MSP level, CE 3.0 can:

- Streamline merchant adoption of advanced fraud controls

- Automate evidence gathering for disputed transactions

- Improve portfolio chargeback ratios by shifting liability to issuers

DisputeHelp’s DEFLECT solution offers out-of-the-box support for CE 3.0 and Mastercard First-Party Trust. These integrations support compliance and reduce friction for merchants with elevated risk.

Scaling Prevention Across Your Portfolio

Implementing chargeback prevention at scale requires balancing standardization with flexibility. For MSPs, that means:

Standardized Core Protocols

Use consistent chargeback alert integrations, fraud screening thresholds, and authentication standards across merchant segments.

Merchant-Specific Customizations

Tailor billing descriptors, fraud rules, and customer comms to suit vertical-specific needs—e.g., digital goods vs. travel vs. subscription services.

DisputeHelp’s platform is built to support this structure. Alerts, representment, and reporting workflows can be managed centrally while offering merchant-level granularity.

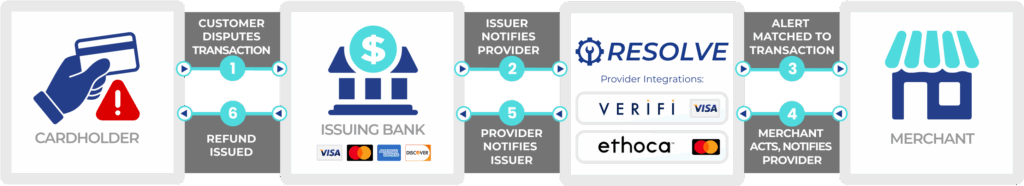

Layering in Chargeback Alerts

Chargeback alert services are especially critical for high-risk portfolios. They give MSPs and merchants a brief window to refund transactions before chargebacks occur. Options include:

- Ethoca Alerts: Near real-time dispute notifications

- Verifi CDRN: Refund-before-chargeback workflow

- Visa RDR: Auto-resolves eligible disputes at issuer level

- Mastercom Collaboration: Dispute alerts for Mastercard transactions

Each of these can be managed through DisputeHelp’s centralized alert infrastructure. Alerts not only reduce dispute volume but help prevent regulatory intervention tied to chargeback overages.

Where Do We Go From Here?

If you’re managing a high-risk merchant portfolio, it’s time to reframe chargeback prevention as a centralized, automated discipline. Start with a risk audit across your portfolio. From there, deploy authentication upgrades, alert services, and CE 3.0-compliant integrations. DisputeHelp can help your team implement and manage these solutions at scale. Reach out to our chargeback experts to discuss a portfolio-specific strategy.

Why DisputeHelp?

DisputeHelp offers enterprise-grade chargeback prevention solutions purpose-built for MSPs. Our platform consolidates alerts, CE 3.0, and representment workflows into a single white-label interface that integrates directly into your merchant accounts. With automated risk controls and scalable tools, we help you maintain compliance, improve processing volumes, and reduce operational stress across your high-risk merchant base. Contact our team to learn how we can support your portfolio.

FAQs: Chargeback Prevention for High-Risk Portfolios

What defines a high-risk merchant portfolio?

A high-risk merchant portfolio contains businesses in industries with elevated chargeback ratios or fraud risk, such as gaming, dating, or nutraceuticals. DisputeHelp supports MSPs in managing and protecting these portfolios at scale.

How do chargeback alert services benefit high-risk portfolios specifically?

Alerts notify merchants before disputes escalate into chargebacks. For high-risk merchants, this early warning can prevent chargeback spikes. DisputeHelp’s alert infrastructure handles this process automatically.

What chargeback prevention technologies deliver the best ROI?

Compelling Evidence 3.0 and chargeback alerts typically offer the highest ROI. DisputeHelp integrates both within a single platform for maximum impact.

How can MSPs balance prevention cost against risk?

MSPs should adopt tiered strategies based on merchant risk. DisputeHelp supports this with flexible tools and workflows that align cost to exposure level.

What are the warning signs of a portfolio liability?

Spikes in chargeback rates, abnormal transaction volumes, or reason code shifts may indicate merchant-level issues. DisputeHelp’s tools help flag these early.

How often should strategies be reviewed?

Monthly for high-risk merchants and quarterly for the full portfolio. DisputeHelp provides the dashboards and reports MSPs need to monitor and act quickly.