The Stakes Why Chargeback Prevention Matters

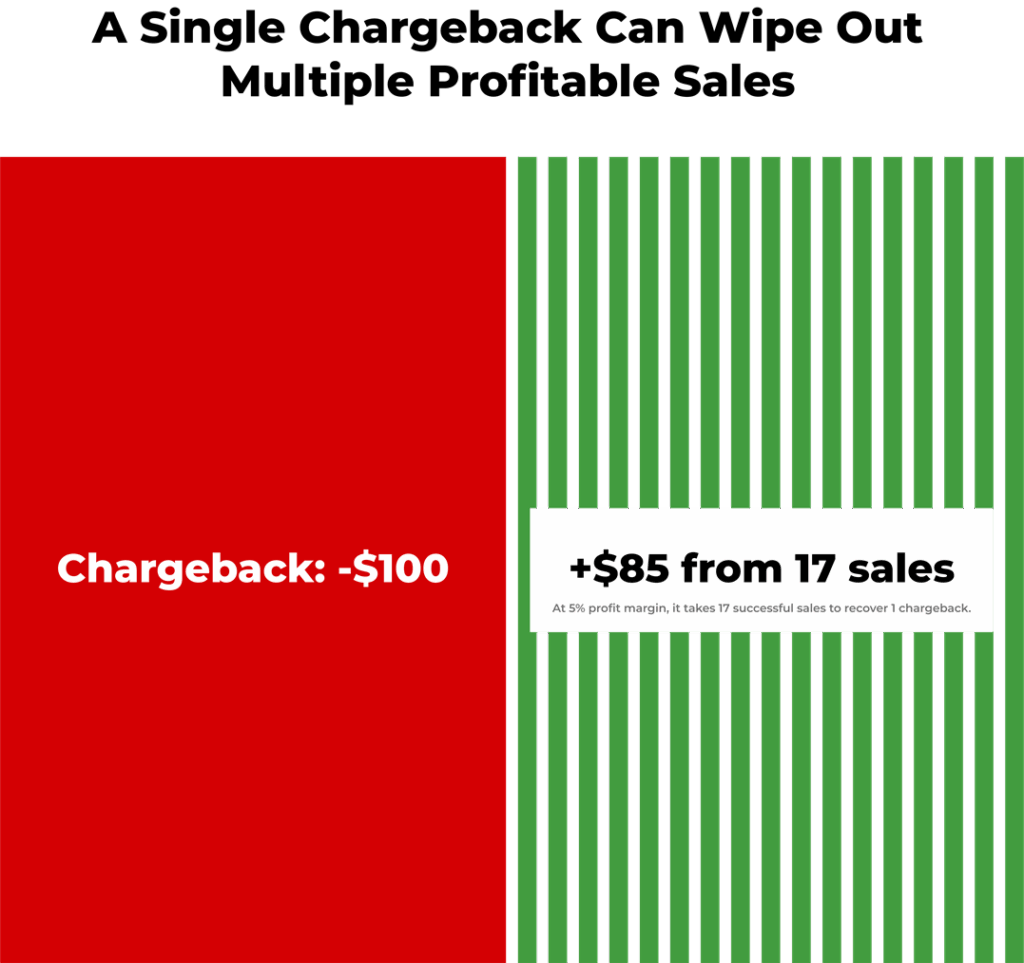

Chargebacks, left unchecked, can quietly erode merchant profitability and expose MSPs to systemic portfolio risk. When merchants exceed network chargeback thresholds, it triggers costly consequences, including placement in monitoring programs and potential restrictions on processing capabilities. This not only threatens individual merchant accounts but can also jeopardize MSP-acquirer relationships. Chargeback prevention isn’t optional. It’s essential to meet card network expectations and safeguard long-term portfolio stability.

Disputes vs Chargebacks: Why Dispute Resolution Is the Heart of Prevention

It’s important for MSPs to clearly understand that disputes and chargebacks represent two distinct stages of the same process. We define disputes as beginning when a cardholder questions or challenges a transaction with their issuing bank. This is the point where intervention is still possible without penalty. A chargeback, on the other hand, occurs when the dispute is escalated and the funds are forcibly reversed from the merchant’s account. That’s when costs, penalties, and potential placement in monitoring programs come into play.

Chargeback prevention is really about dispute resolution, stopping disputes from escalating to formal chargebacks. The sooner you can address a dispute, the better the chance of avoiding a chargeback entirely. This is why prevention efforts focus on fast, effective resolution at the earliest possible stage, rather than waiting for chargebacks to occur and then trying to fight them.

Core Chargeback Prevention Measures for MSPs

Merchant service providers have several powerful tools at their disposal to deliver that fast, early-stage resolution and shield their merchant accounts. Solutions like Verifi Order Insight and Ethoca Consumer Clarity share transaction and fulfillment data in real time, helping card networks and issuers resolve cardholder confusion before a dispute is even filed. Meanwhile, Mastercom Collaboration and Visa Rapid Dispute Resolution provide automated resolution options that act the moment a dispute is initiated, preventing escalation to a chargeback.

What sets chargeback prevention apart from chargeback management is this focus on proactive action. Chargeback management often involves representment or fighting chargebacks after they’ve already been posted, which means the damage (fees, penalties, and network scrutiny) has already begun. Prevention, through early dispute resolution, helps MSPs and their merchants stay ahead of that curve.

Integration and Automation Making Prevention Scalable

One of the most pressing concerns for merchant service providers is how to scale chargeback prevention without creating operational bottlenecks. This is where integration and automation come in. Modern prevention solutions, like those we make available through DisputeHelp, support seamless API integrations that connect directly to merchant CRMs, gateways, and e-commerce platforms. With a single integration point, MSPs can deploy chargeback prevention across thousands of merchants efficiently.

Automation eliminates the need for constant manual intervention, ensuring that dispute data and resolutions are processed in real time. White-label options also allow MSPs to present these services under their own brand, strengthening merchant relationships and creating a differentiated offering in a competitive market.

Turning Prevention Into a Competitive Advantage

Offering chargeback prevention is more than just a compliance requirement. It’s a way for MSPs to stand out as trusted partners. By proactively protecting merchant accounts, MSPs help their clients avoid penalties, keep their dispute-to-transaction ratios within card network tolerance levels, and sustain long-term processing capabilities. This proactive support builds merchant loyalty and can open up new opportunities for value-added services that drive revenue.

At the end of the day, merchants are more likely to stay with providers who help them avoid costly disputes and chargebacks. Prevention solutions become a key part of the MSP’s value proposition.

Next steps

If you’re ready to protect your portfolio with chargeback prevention that integrates seamlessly, scales efficiently, and helps you retain merchant trust, reach out to our team today. DisputeHelp can work with you to design a chargeback prevention strategy that fits your business model and supports your merchants at scale.

Why DisputeHelp?

DisputeHelp offers a full suite of chargeback prevention and management solutions designed specifically for MSPs. Our platform integrates with major network tools, offers automation to reduce manual workload, and provides white-label capabilities so you can present these services as your own. By partnering with us, you gain a competitive advantage in managing disputes, chargebacks, and merchant relationships at scale.

FAQs: Chargeback Prevention for MSPs

What is chargeback prevention for MSPs?

Chargeback prevention refers to proactive measures that MSPs put in place to stop disputes from escalating into chargebacks, helping to protect merchant accounts and portfolios. DisputeHelp offers integrated solutions that make this easy to manage.

How do Verifi Order Insight and Ethoca Consumer Clarity support chargeback prevention?

These solutions provide real-time transaction details to card networks and issuers, helping resolve confusion at the inquiry stage. DisputeHelp makes it simple to integrate these tools across your merchant portfolio.

Can chargeback prevention be automated across an MSP’s portfolio?

Yes, automation is key for scale. DisputeHelp’s solutions allow MSPs to automate processes, reducing manual effort and ensuring timely intervention before chargebacks occur.

What are the benefits of white-label chargeback prevention solutions?

White-label solutions allow MSPs to offer prevention services under their own brand, which strengthens merchant relationships and helps with client retention. DisputeHelp provides fully white-label-ready tools.

Why is layered chargeback prevention important?

Using multiple prevention tools ensures coverage at various stages of the dispute lifecycle. This layered approach helps minimize risk and maintain compliance. DisputeHelp can guide you through building a layered prevention strategy.

What impact does chargeback prevention have on merchant retention?

Merchants who see fewer chargebacks are more likely to stay with their MSP. Prevention solutions support this by keeping chargeback ratios low and protecting accounts. DisputeHelp helps MSPs achieve these goals.

How can I get started with DisputeHelp’s chargeback prevention solutions?

The best way to get started is to contact us for a personal consultation. Our team will take the time to understand your business model, merchant portfolio, and specific chargeback challenges. From there, we’ll help you determine the most viable chargeback prevention strategy, tailored to your needs and goals.