Two Networks, Two Resolution Paths

Verifi Order Insight and Ethoca Consumer Clarity each serve the same purpose: helping issuers and cardholders understand unfamiliar transactions before a dispute is filed. But they do it in slightly different ways.

Order Insight is part of Visa’s Verifi suite and routes merchant data directly to the issuer’s app and call center support screen. It is a critical component of Visa’s Compelling Evidence 3.0 framework. Consumer Clarity does the same for Mastercard transactions, publishing similar transaction and fulfillment details within issuer tools. It aligns with Mastercard’s First-Party Trust initiative.

The differences start to show in how each service reaches issuers, how data is formatted, and how integrations are managed.

Issuer Reach and Data Visibility

Both platforms offer strong issuer-side visibility, but Visa’s reach is broader in the U.S. due to early adoption and integration by domestic banks. Mastercard’s Consumer Clarity, however, sees deeper penetration across certain international markets and within specific regional banking ecosystems.

For an MSP managing a global merchant portfolio, the best-fit option may vary depending on merchant geography. That’s one reason why more providers are choosing to implement both. If a merchant handles a mix of Visa and Mastercard transactions, full protection requires visibility into both networks.

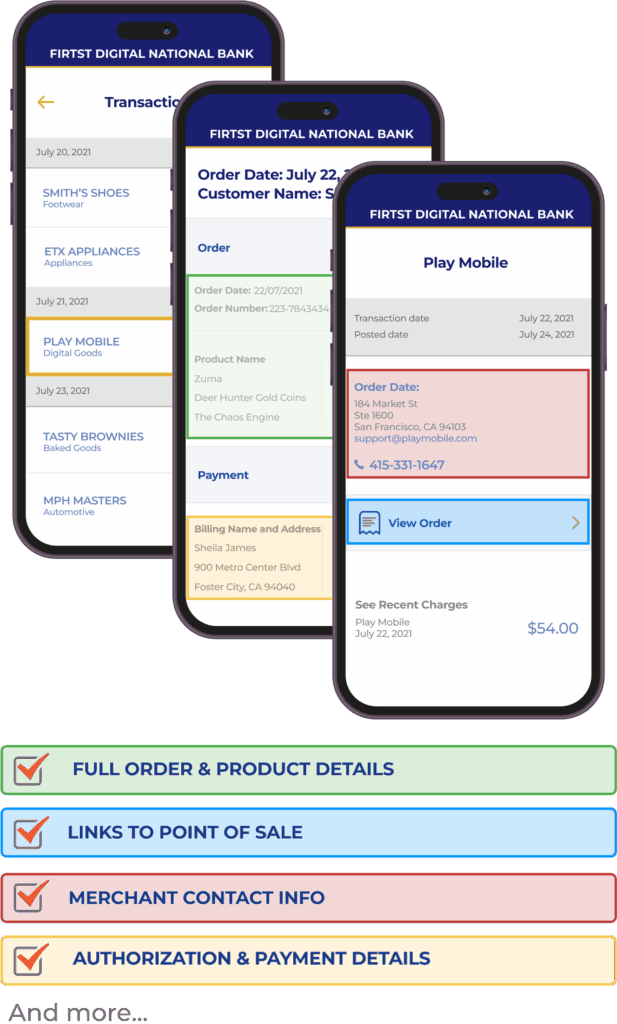

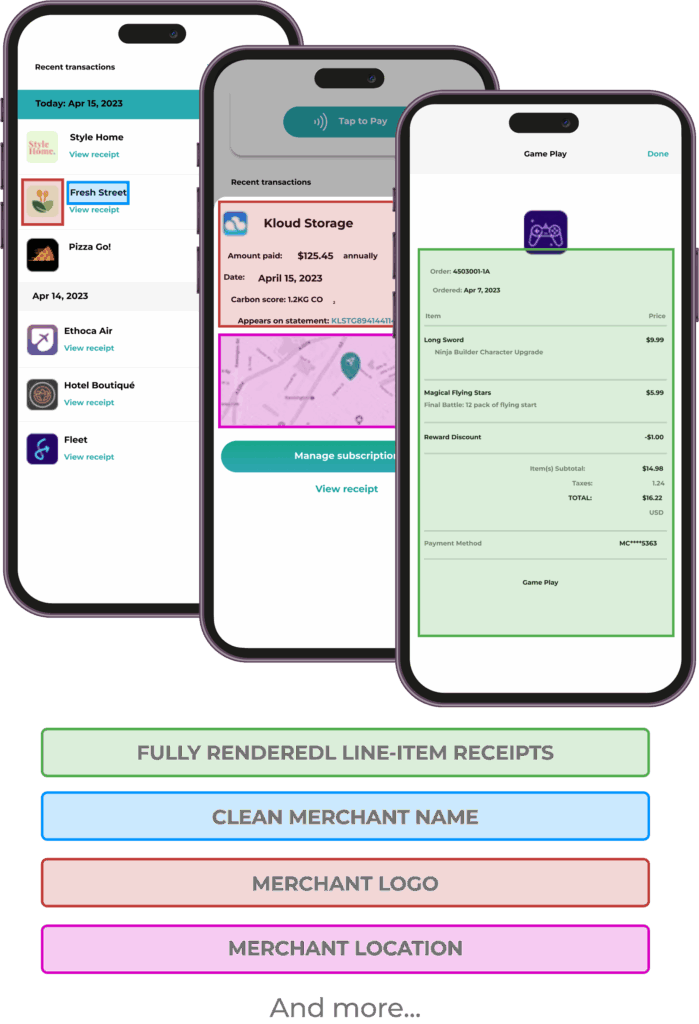

In terms of visibility, both platforms provide:

- Merchant name, location, and logo

- Itemized order summaries

- Contact information and support links

- Digital receipts, device fingerprints, and shipping status (when available)

- And more…

Consumer Clarity has slightly greater flexibility in fulfillment data, while Order Insight leans toward transactional transparency that supports dispute prevention under CE3.0.

Verifi Order Insight

Ethoca Consumer Clarity

Integration and Data Requirements

Implementation complexity varies depending on the scale of the merchant portfolio and the level of automation in place. Both platforms support API-based data retrieval, allowing merchant CRMs, gateways, and fulfillment tools to send real-time data to card networks when cardholders view their transaction history.

But the requirements differ slightly. Order Insight requires structured formats that align with Visa’s CE3.0 guidelines. Ethoca Consumer Clarity supports similar formats, but is often more flexible on fulfillment signals. Either way, most MSPs are not configuring these pipelines manually. They’re looking for a managed service or platform that can ingest transaction and fulfillment data and push it to both networks automatically.

DisputeHelp’s DEFLECT accomplishes exactly this. It connects merchant assets to both Order Insight and Consumer Clarity through a single integration, reducing engineering time and ensuring standardized outputs across both networks.

Support for CE3.0 and Mastercard FPT

Visa CE3.0 and Mastercard FPT are not optional for MSPs seeking to maintain risk thresholds across their merchant base. These programs define the evidence types and formatting needed to prove that a transaction was legitimate, especially in cases of first-party fraud.

Order Insight is a foundational component of CE3.0, making it essential for merchants hoping to qualify for automatic fraud dispute rejections. Likewise, Consumer Clarity is now critical to triggering Mastercard’s auto-resolution workflows through FPT.

Failing to integrate these programs doesn’t just mean fewer disputes resolved, it could eventually mean higher ratios and more chargebacks.

Choosing Order Insight, Consumer Clarity, or Both

Verifi Order Insight and Ethoca Consumer Clarity do the same job. They deliver merchant and fulfillment data to issuers at the moment of cardholder confusion. The only difference is the network: Order Insight is for Visa, and Consumer Clarity is for Mastercard. Supporting one without the other creates an immediate gap in protection.

For MSPs managing merchant portfolios this gap can become costly. Relying on just one tool means that every transaction on the other network goes unresolved, leaving merchants vulnerable to disputes that could have been prevented.

Some providers hesitate to implement both tools due to perceived complexity. But that concern doesn’t hold up when you use a robust dispute management platform.

DisputeHelp connects both Order Insight and Consumer Clarity through a single integration point, eliminating the operational burden. No added lift for merchants, no fragmented reporting, and no inconsistent outcomes across card networks.

Offering both ensures full network coverage, unified reporting, and consistent protection across your portfolio. It also makes it easier to layer in chargeback alerts and representment automation using the same system, creating a seamless approach to dispute prevention and revenue recovery.

Next steps: Bring It All Together Through One Platform

You don’t need to choose between Ethoca Consumer Clarity and Verifi Order Insight. At least, not if you use the right partner. DisputeHelp integrates both into a single white-labeled resolution layer for your entire merchant portfolio. That means fewer blind spots, more automated outcomes, and better alignment with Visa and Mastercard compliance rules. If you’re ready to simplify implementation while increasing protection, reach out to our team for a tailored integration plan.

Why DisputeHelp?

DisputeHelp gives MSPs a strategic edge by combining all network-aligned resolution and alert services under one unified platform. With automated workflows for CE3.0 and FPT, API-ready integrations, and white-label capabilities that let you own the client relationship, our platform reduces operational strain and increases merchant retention. We serve clients in 20+ countries and help keep dispute ratios within network thresholds. Contact us today to learn more about how our chargeback management solutions work.

FAQs: Choosing Between Order Insight and Consumer Clarity

What’s the main difference between Order Insight and Consumer Clarity?

Order Insight is for Visa transactions, while Consumer Clarity is for Mastercard. Both deliver merchant data to issuers to prevent disputes, but integration details differ. DisputeHelp handles both through a single platform.

Do I need to implement both tools?

If your merchants process both Visa and Mastercard, yes. Skipping one leaves coverage gaps. DisputeHelp allows MSPs to deploy both tools without extra overhead.

What kind of data do these services provide to issuers?

They share merchant name, itemized orders, receipts, fulfillment status, and device info. This helps resolve confusion early. Our DEFLECT platform ensures all required data is captured and formatted correctly.

How do these tools support CE3.0 and FPT compliance?

Each aligns with its respective network’s guidelines. Using them properly helps merchants qualify for auto-resolution workflows and lowers dispute risk.

Can merchants manage this themselves?

Technically yes, but most prefer it white-labeled through their provider. DisputeHelp supports fully branded deployments that offer both Order Insight and Consumer Clarity.