Visa Acquirer Monitoring Program: The End of Outlier Management

Visa’s VAMP replaces VFMP and VDMP with a lifecycle risk management approach that monitors the acquirer’s entire merchant portfolio. This is a decisive move away from the previous model, where acquirers could often isolate and manage risk by simply dropping problematic merchants. Now, the entire portfolio’s performance matters.

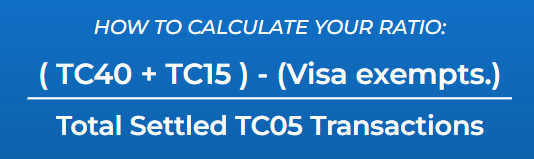

The VAMP ratio is the new metric at the heart of this program. It combines all reported fraudulent transactions (TC40 notices) and non-fraud disputes (TC15 notices), divided by total settled transactions for the acquirer’s merchant portfolio. This single, unified ratio streamlines compliance but significantly raises the stakes for MSPs who have relied on compartmentalized risk management.

Unified Metrics and Stricter Thresholds: What’s Different Under VAMP

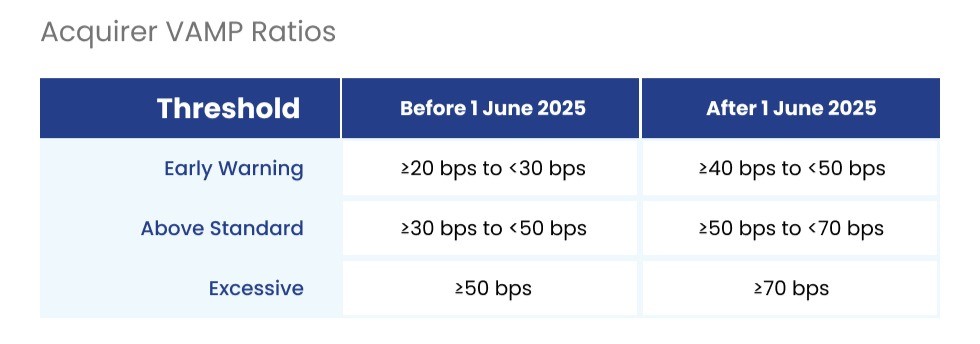

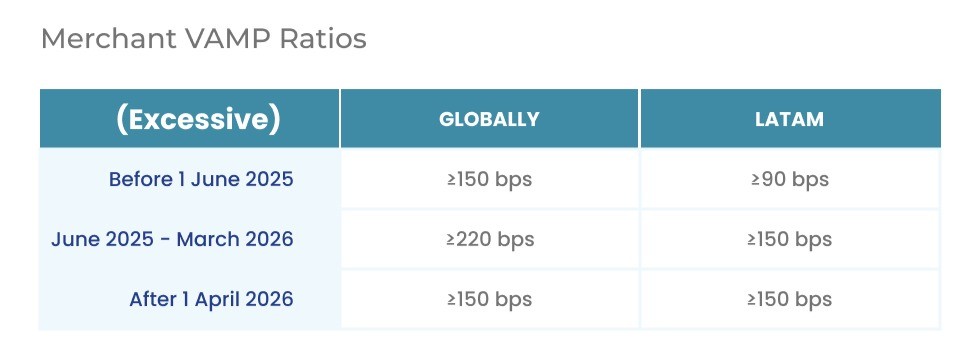

VAMP’s introduction brings clear, measurable thresholds—and they’re tighter than ever before. The initial enforcement phase (April 1 to December 31, 2025) sets the “excessive” acquirer ratio at 0.5%. UPDATED (5/15/25): Starting January 1, 2026, the “above standard” ratio drops to 0.3%, while the excessive merchant threshold falls to 0.9%. These numbers are not just technicalities; they represent a dramatic reduction in Visa’s tolerance for portfolio-level risk.

Another critical change is the updated treatment of dispute resolution tools under VAMP. As of Visa’s March 2025 policy update, fraud-related disputes that are successfully resolved through Rapid Dispute Resolution (RDR) or Verifi CDRN are now excluded from VAMP ratio calculations. This marks a significant shift from earlier guidance and gives MSPs a clear incentive to integrate these tools.

How VAMP Reshapes MSP Risk and Portfolio Management

For MSPs, VAMP’s lifecycle risk management approach means that risk must be managed holistically, not reactively. The days of simply terminating high-risk merchants to avoid network scrutiny are gone. Instead, MSPs need to:

- Implement real-time portfolio monitoring for both fraud and dispute activity

- Engage proactively with merchants to address root causes of disputes and fraud

- Educate merchant clients on the new compliance standards and the consequences of exceeding thresholds

- Leverage advanced analytics and reporting to identify emerging risks before they threaten portfolio compliance

MSPs must also be ready to handle the operational impact of Visa’s advisory and enforcement periods. From April 1 to September 30, 2025, VAMP operates in an advisory mode—no penalties, but plenty of warnings. After October 1, enforcement begins, and penalties for non-compliance are immediate and significant.

The New Role of Automation and Real-Time Resolution

Automation is no longer optional for MSPs seeking to stay below VAMP thresholds. Visa’s RDR and Order Insight remain essential solutions for resolving disputes before they escalate, but their strategic value has shifted.

While non-fraud disputes resolved through these channels are still excluded from the VAMP ratio, fraud-related disputes are not. This means MSPs must:

- Fine-tune RDR rules and workflows to maximize the prevention of non-fraud chargebacks

- Encourage merchants to use Order Insight to provide transaction details and reduce unnecessary disputes

- Integrate real-time monitoring and alerting systems to flag potential enumeration attacks and spikes in dispute activity

For those needing a practical solution, the VAMP calculator can help MSPs and acquirers monitor their ratios in real time and model the impact of different mitigation strategies.

Strategies for Staying Below VAMP Thresholds

Staying compliant under VAMP requires a multi-layered strategy:

Portfolio-Level Risk Assessment

MSPs must regularly assess their entire merchant portfolio for patterns of fraud and dispute activity, not just individual outliers. This helps to identify systemic issues before they escalate.

Merchant Engagement and Education

Proactive communication with merchants is essential. MSPs should provide guidance on best practices for fraud prevention, dispute management, and compliance with VAMP’s stricter standards.

Robust Fraud Prevention

Deploy advanced fraud detection tools, monitor for enumeration attacks, and use transaction velocity checks. These are now baseline requirements.

Automated Dispute Resolution

Utilize RDR and Order Insight + CE3.0 to resolve disputes quickly, especially non-fraud disputes, which can still be excluded from the VAMP ratio.

Proactive Alerts Integration

Deploy chargeback alert tools like Verifi CDRN and Ethoca Alerts across your merchant portfolio. As of May 2025, resolved fraud alerts now reduce VAMP ratio exposure.

Continuous Monitoring and Reporting

Use real-time dashboards and regular reporting to track VAMP ratios and enumeration metrics. When a threshold is at risk, act fast.

Where Do We Go From Here?

The Visa Acquirer Monitoring Program is not just a compliance update—it’s a call for MSPs to rethink risk management from the ground up. With stricter thresholds, unified metrics, and a focus on portfolio-wide accountability, only those who adapt quickly will avoid penalties and maintain strong relationships with both Visa and their merchant clients.

Why DisputeHelp?

DisputeHelp offers the automation, analytics, and white-label solutions MSPs need to thrive under the Visa Acquirer Monitoring Program. Our platform enables real-time monitoring, advanced fraud detection, and seamless integration with Visa’s dispute resolution solutions. With DisputeHelp, you can reduce systemic portfolio risk, maintain compliance, and deliver value-added services to your merchants—all under your own brand. Contact us to see how our solutions can help you stay ahead of VAMP and drive better outcomes for your business.

FAQs: What is Visa’s New VAMP Program and How Will it Affect Merchants

What is the Visa Acquirer Monitoring Program (VAMP)?

VAMP is Visa’s unified compliance framework that holds acquirers and MSPs accountable for fraud and dispute activity across their entire merchant portfolio. DisputeHelp can help you track and manage your VAMP ratio for ongoing compliance.

How is the VAMP ratio calculated?

The VAMP ratio is calculated by dividing the total number of reported fraudulent transactions (TC40 notices) and non-fraud disputes (TC15 notices) by total settled transactions. As of May 15, 2025, this calculation excludes any disputes resolved through pre-dispute products like RDR, Verifi CDRN, and Ethoca Alerts. DisputeHelp’s VAMP calculator reflects this update to help MSPs stay accurately informed and compliant.

What are the new VAMP thresholds for acquirers and merchants?

UPDATED (5/15/25): For acquirers, the excessive threshold is 0.5% in 2025, dropping to 0.3% in 2026. For merchants, it’s 1.5% in 2025, dropping to 0.9% in 2026. DisputeHelp can alert you when you are nearing these limits.

Are disputes resolved via RDR or CDRN excluded from the VAMP ratio?

UPDATED (5/15/25): Only non-fraud disputes resolved through RDR or CDRN are excluded. Fraud-related disputes now count toward the VAMP ratio. DisputeHelp can help you optimize your dispute resolution workflows accordingly.

What is the enumeration ratio and why does it matter?

The enumeration ratio tracks suspicious transaction attempts, such as card testing attacks. Exceeding a 20% enumeration ratio can trigger enforcement. DisputeHelp provides solutions to monitor and mitigate these risks.

How can MSPs stay compliant with VAMP?

By implementing real-time monitoring, engaging merchants proactively, and leveraging automated dispute resolution tools. DisputeHelp offers all these capabilities in a single platform.

What happens if an acquirer or merchant exceeds the VAMP threshold?

Visa will issue advisory notifications during the grace period and impose penalties after enforcement begins. DisputeHelp can help you avoid these outcomes with proactive risk management and compliance support.