Ethoca Consumer Clarity is transforming the dispute ecosystem by improving transaction transparency, reducing unnecessary disputes, and strengthening customer trust. By making detailed transaction data available inside issuer apps, it helps customers quickly recognize legitimate purchases, cutting down on confusion-driven disputes. This article explores the importance of Ethoca Consumer Clarity, its impact on merchant service providers, and how businesses can leverage it to improve dispute outcomes and operational efficiency.

The Dispute Ecosystem at a Glance

The dispute ecosystem brings together merchants, issuers, and customers, each with their own perspectives and pressures. Customers want clarity and fairness when something looks wrong on their statement. Issuers want to protect cardholders while keeping operations efficient. Merchants want to minimize disputes and protect revenue. But here’s the challenge: 77% of consumers often find unrecognizable transactions in their online statements, leading to potential disputes (Source: Mastercard). Maybe the statement descriptor is unclear, or maybe a family member made the purchase. Whatever the reason, the result is the same-a dispute that drains time and money from everyone involved.

What Is Ethoca Consumer Clarity?

Ethoca Consumer Clarity is a solution developed to address this problem head-on. It integrates directly into participating issuer apps and online banking portals, providing cardholders with rich transaction details in real time.

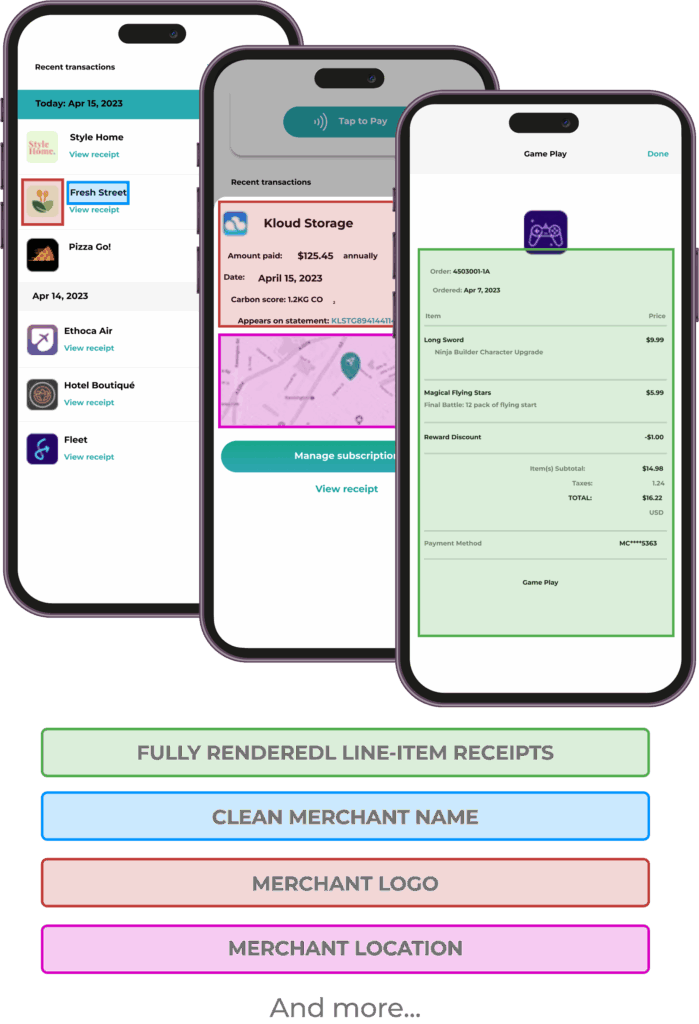

Instead of seeing a confusing line on a statement, customers can view:

- Merchant name and logo

- Purchase location and date

- Itemized order details

- Merchant contact information

- And more…

This level of transparency helps customers identify their purchases, reducing the likelihood of unnecessary disputes. It’s a no-brainer for improving both customer experience and back-office efficiency.

Ethoca Consumer Clarity – Unrivaled Transparency for Customers

Benefits to MSPs and the Broader Ecosystem

For merchant service providers, Ethoca Consumer Clarity offers major advantages:

- Reduced Dispute Volume: By preventing confusion-driven disputes, merchants see fewer chargebacks and fewer lost sales. This also helps protect merchant accounts from excessive chargeback ratios that can trigger penalties.

- Improved Transparency: Detailed data builds trust with customers and issuers alike. When shoppers and banks have clearer purchase information, resolution times also improve.

- Enhanced Customer Satisfaction: Shoppers feel more confident when they can easily verify their purchases. This strengthens brand loyalty and encourages repeat business.

- Operational Efficiency: Fewer disputes mean less time spent on administrative tasks and more focus on running the business. It also frees up customer service teams to handle higher-value interactions.

In the larger ecosystem, these improvements help issuers reduce call center volume and enhance cardholder satisfaction. Everyone wins.

And importantly, when merchants combine Ethoca Consumer Clarity with other chargeback prevention solutions, the impact on their bottom line can be even greater.

Best Practices for Merchant Service Providers

To get the most from Ethoca Consumer Clarity, MSPs should:

- Ensure Accurate Data Submission: Send clear, detailed order data to Ethoca to ensure the customer’s view is as helpful as possible.

- Align Internal Teams: Coordinate between payment, fraud, and customer service teams to keep data flows consistent and complete.

- Track Performance Metrics: Monitor dispute reduction rates, customer feedback, and operational savings to evaluate ROI and adjust as needed.

Chances are, merchants that treat this as a cross-functional initiative, not just a payments project, will see the strongest results.

The Future of Dispute Management with Consumer Clarity

Looking ahead, the role of Ethoca Consumer Clarity will only expand. More issuers are joining the network, extending its reach worldwide. Data sharing will become richer, giving customers an even clearer picture of their purchases. And with AI on the horizon, merchants can expect predictive insights that help them stop disputes before they even start.

At the end of the day, Ethoca Consumer Clarity is laying the groundwork for a smarter, more collaborative dispute ecosystem.

Ready to Maximize the Value of Ethoca Consumer Clarity?

If you’re ready to leverage Ethoca Consumer Clarity to improve your dispute outcomes, DisputeHelp is here for you. Our team has deep experience integrating this solution, aligning it with your internal systems, and ensuring you get the maximum benefit. Contact us today to see how we can help reduce disputes and improve customer satisfaction.

Why DisputeHelp?

DisputeHelp delivers end-to-end dispute management solutions, including Ethoca Consumer Clarity, Verifi Order Insight, and robust chargeback prevention tools. With powerful automation, advanced analytics, and our standout white label feature, we help merchants optimize dispute resolution, reduce losses, and protect brand reputation. Whether you need a ready-to-deploy platform or a fully customized solution, DisputeHelp has the tools and expertise to help you stay ahead.

FAQs: How Ethoca Consumer Clarity Transforms Dispute Management

What is Ethoca Consumer Clarity?

It’s a solution that delivers detailed transaction information directly to customers through their bank apps. This transparency helps customers recognize purchases, reducing unnecessary disputes.

How does Ethoca Consumer Clarity benefit merchant service providers?

Merchant service providers experience fewer disputes, better merchant relationships, and operational cost savings. It also helps protect revenue by preventing avoidable chargebacks.

What type of information is shared with customers?

Details like merchant name, logo, date, location, itemized orders, and contact info are provided. This helps customers identify transactions quickly.

Is Ethoca Consumer Clarity difficult to implement?

It can be, yes. Integrating Ethoca Consumer Clarity into merchant operations can present technical challenges and may require additional IT resources to ensure compatibility with existing systems. While the solution offers robust chargeback prevention, its full effectiveness depends on seamless integration. With DisputeHelp’s support, merchants can achieve a smooth implementation, ensuring accurate data flows to issuers and maximizing the benefits of Consumer Clarity.

Can Ethoca Consumer Clarity eliminate all disputes?

Not all, but it significantly reduces those caused by confusion. Combined with other solutions, it forms a powerful defense against chargebacks.

What industries benefit most from using it?

E-commerce, travel, subscription services, and digital goods providers often see the largest improvements due to high transaction volumes and frequent customer inquiries.

Is customer data shared securely?

Yes, Ethoca Consumer Clarity follows strict security and compliance standards to protect customer data. All shared information is transmitted using secure protocols and handled in accordance with industry regulations. Merchant service providers, as well as merchants, can feel confident that sensitive details are safeguarded throughout the process.