Effective April 1, 2025

Visa is retiring its existing fraud and dispute monitoring programs by merging them into a single, streamlined framework called the Visa Acquirer Monitoring Program (VAMP). This move will have significant consequences for acquiring banks and payment service providers.

Specifically, VAMP shifts the compliance focus from “outlier management” of individual merchants to what Visa calls a “lifecycle risk management approach”, bringing acquirers and other PSPs into the scope of accountability for fraud and disputes. This transition aims to provide more comprehensive fraud prevention across the payments ecosystem, featuring the following key elements:

1. Unified Monitoring

VAMP consolidates existing fraud and dispute programs into a single framework intended to simplify compliance efforts for stakeholders. The program introduces a combined metric that calculates monthly fraud and dispute levels together against overall transaction volume, at both the acquirer and merchant level:

(Total TC40 Notices + Total TC15 ) – ( Designated Visa Exemptions )

÷ Total Settled Transactions

- TC40 Notices: Reports of fraudulent transactions.

- TC15 Notices: Non-fraud dispute reports.

The VAMP ratio is determined by adding the total monthly TC40 fraud notices and TC15 non-fraud disputes generated by an acquirer’s merchant portfolio, minus any exempt resolutions designated by Visa (more below on this) and dividing by the portfolio’s total monthly transaction volume:

2. Revised Ratio Thresholds

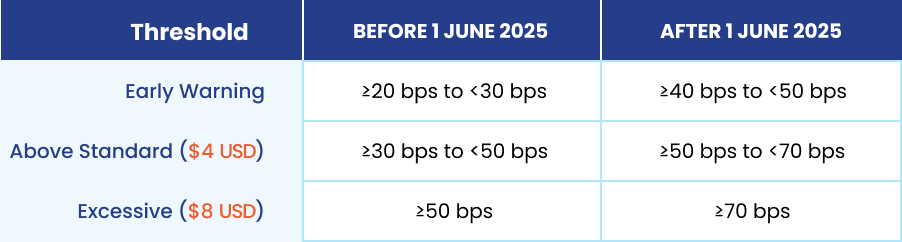

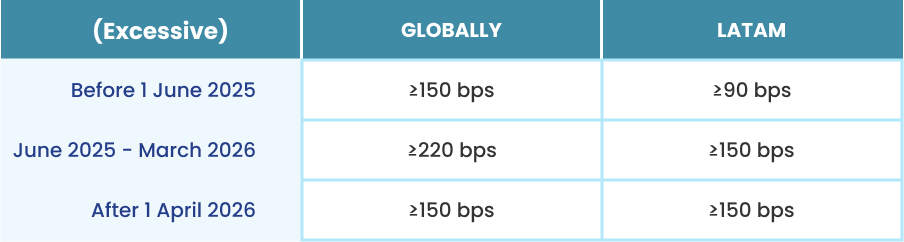

Transitioning from a non-compliance assessment of individual merchants exclusively, VAMP also revises the ratio thresholds which will trigger enforcement action from Visa. This risk-based enforcement strategy has two tiers: for merchants and acquirers, which offers acquirers some flexibility to balance varying levels of risk within their portfolios:

Acquirer ratios are listed here, including penalties in red for each disputed transaction once the ratios are exceeded for that level:

Merchant ratios are as follows; the merchant is charged a flat $8 USD for each dispute once they exceed the ratios listed:

3. Important Exemptions (as of June 2025)

Ratio exemptions have been one of the more dynamic aspects of VAMP. However, as it stands now, any TC40/TC15 record will count once generated. Visa has gone back and forth on this, but as of June 2025, any resolutions that block or cancel TC records are subtracted from the total.

- Deflection tools: like Verifi Order Insight & Ethoca Consumer Clarity, and Visa’s Compelling Evidence 3.0 framework all prevent disputes so that no TC record is generated.

- Visa’s Rapid Dispute Resolution automation resolves disputes in a designated “pre-dispute” phase just before a TC record is created, so again, these resolutions are exempt.

- CDRN and Ethoca Alerts are the newest exemptions added by Visa, as these resolution tools now cancel a dispute’s TC15 record when it is refunded using alerts.

Implications for Acquirers

In order to effectively maintain compliance and contribute to this lifecycle risk management approach, acquirers must take some crucial steps:

1. Compliance Tracking:

Acquirers must implement robust monitoring systems to track the unified fraud and dispute ratios, to ensure merchant compliance with the new thresholds.

2. Monitor Communications

Acquirers will be notified on Visa’s OneERS platform as they approach the Excessive Ratio designation.

3. Proactive Merchant Engagement

Acquirers should encourage a dialog with their merchants to identify and address potential risks early.

Get Prepared!

Enforcement will begin October 1, 2025 to allow stakeholders to adjust. So there is still time to act! We recommend taking the following steps for a smooth transition to the new program:

1. Integrate Comprehensive Dispute Resolution Tools

2. Upgrade Dispute Monitoring Systems:

3. Educate and Train Compliance Teams:

4. Engage with Merchants:

DisputeHelp Is Here To Help

By proactively adapting to these changes, your business can effectively navigate this dynamic compliance landscape, fostering a more secure and efficient payments ecosystem in the process.

Navigating the new VAMP requirements can be complex. DisputeHelp is here to support you with the products, platforms, and expertise needed to ensure compliance. Contact us today to learn more about how we can help you manage disputes effectively and stay compliant with Visa’s updated monitoring standards!